On August 31st 2025, I ordered a pair of pants. This is not unusual, however the pants happened to originate in the United States, which turned out to be a tremendous mistake I will not make again. I placed the order through Lucky Sweater, a secondhand trading app that traffics primarily in slow fashion brands. Most of what goes on there is the digital equivalent of a swap meet (remember those?), but the app recently introduced a ‘Buy It Now’ function.

In the last few months, my favourite pair of jeans—the cult Rudy Jude utility jeans— had grown tight on me, so I had been sniffing around secondhand and resale sites in search of the next size up. I joined a Rudy Jude Buy/Sell/Trade group on Facebook, started perusing Lucky Sweater, and regularly combed through Poshmark looking for my beloved pants. Rudy Jude items are made in limited quantities so they’re relatively hard to acquire, so they tend to hold their value and command pretty high prices on the secondary market. Since I already had a pair, I hoped to do a pretty straightforward trade of one size for another in the interest of not spending any additional money on pants.

While one trade offer for a distinctly ratty-looking pair of the jeans I was after came through, I couldn’t shake the feeling that I was getting the worse end of the deal, so I declined. (As it turned out, way more people were interested in the babaa sweaters I had listed as potential leverage in case someone wasn’t interested in trading directly for the pants.) I tried a couple more trade suggestions to no avail, so when I saw that a user who had previously ignored me listed the jeans for sale, I placed the order in a righteous flurry of desperation. Trade be damned, I was getting those pants.

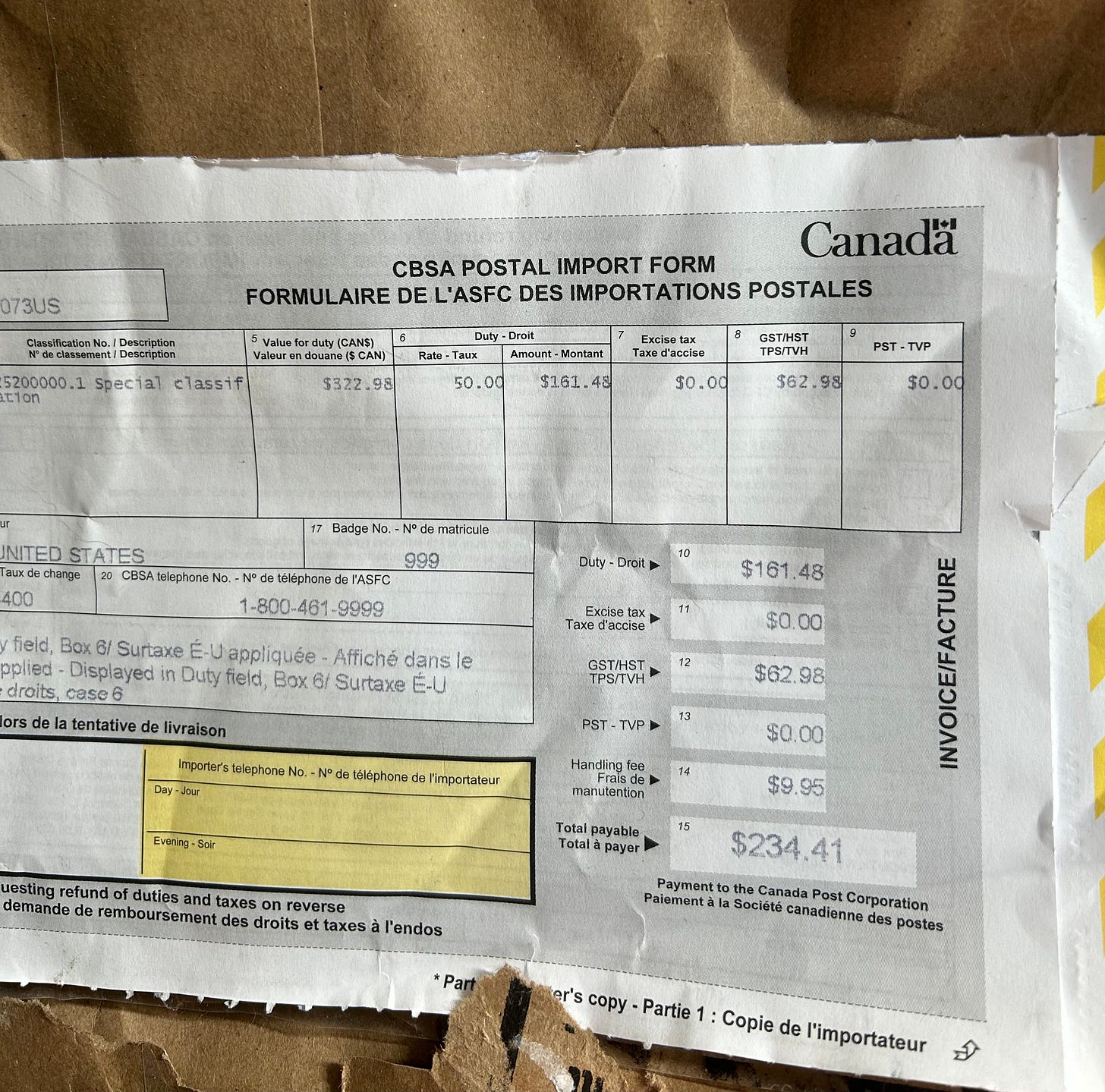

A week after they were shipped, I noticed the USPS tracking page had been updated and the pants were out for delivery. Finally, I would be reunited with the pants I adore and my sad, lacking wardrobe would once again be complete. At 12:30pm, my buzzer rang. I ran down three flights of stairs to meet the mail carrier in the lobby, where he kindly informed me that customs had placed a “fee” that I’d have to pay before he could release the item. “I see here that the value of the item is $322.98, so they’re charging you $161.48 which means the total is,” he hesitated, “$234.41 with tax. Is it worth it to you?”

The question caught me off guard. I balked, genuinely not sure of the answer. While I had expected to pay duties on the shipment, probably in the range of $50-60, I was not expecting a “US Surtax” of 50%. Internally, I weighed my options. The pants are perpetually sold out and even if I could buy a new pair online, they would cost the same amount I was being asked to pay between the tariff and the sale price. The answer to the question is: no, there is no treasure in the world worth that amount of money. But my desire to have these pants was so strong it defied any sort of financial logic. I paid the fee.

The entire thing was extremely humbling. While I was aware of the “de minimis exemption” being repealed, I figured it only applied to the US. Those poor Americans who’d have to pay so much more on their SSENSE orders. (Read this Susan Orlean story recounting her personal experience with tariffs.) Stupidly, I had no idea that I’d get slapped with a counter-tariff that came to 72% of the purchase price.

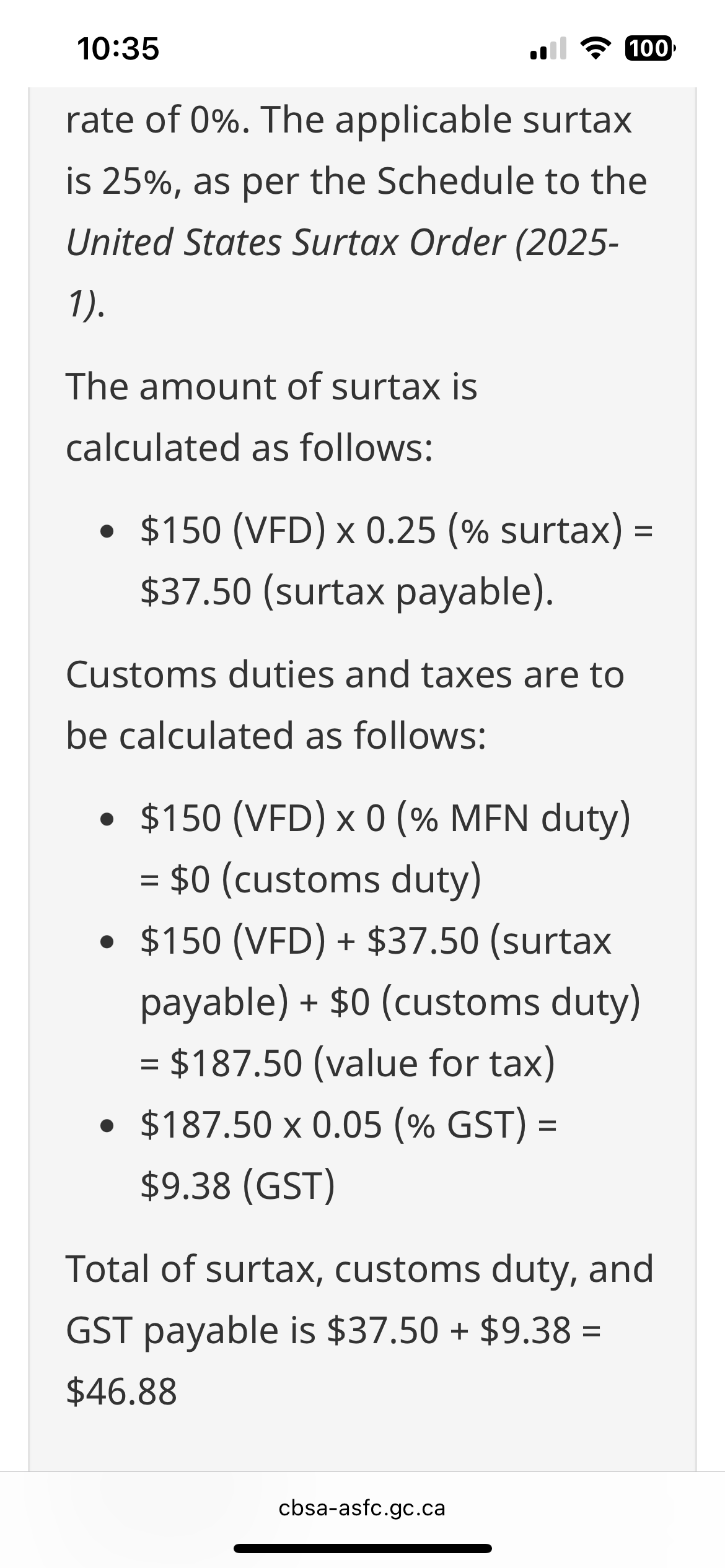

In an attempt to parse what happened, I descended into a perplexing maze of legalese so inscrutable, it made me feel like I was participating in a subplot of the movie Brazil. The CBSA postal import form noted that “US Surtax is applied” in the duty field at a rate of 50%. Looking up “US Surtax,” I found the United States Surtax Order, which appears to be a counter tariff on American steel, iron, aluminum, and vehicles, that was repealed on September 1st. Befuddled, I searched “used clothing” on a website called Canada Tariff Finder, linked by the Department of Finance, and found that the category apparently is subject to a tariff under HS Code 6309, but does not state how much. Plus, everywhere the surtax is listed at 25%, not 50%. Was this the work of a rogue customs agent who enjoys diabolically punishing women with a predilection for expensive designer clothes? I cannot say.

Perhaps the most upsetting part of this encounter, at least for me, was the seller had bafflingly listed the actual price of the jeans on the customs document. Clearly she was unaware of the old fashion trick of underreporting the value to customs so the receiver doesn’t get fleeced. Technically illegal? Yes. But a righteous act of civil disobedience? Absolutely. Thanks to the seller’s Lincoln-esque commitment to honesty, I got bit in the ass.

Since tariff madness began, I’ve been pretty committed to purchasing exclusively from Canadian companies, but this episode made it clear that I actually don’t have a choice.

I won’t make that mistake again.

I had a cheaper but still shocking (bc basically an extra 1/3 of the total price) experience re: some Molly Goddard x Baggu pieces. I really really wanted them. And I vaguely worried as I ordered from the US site (the collab not here in Toronto shops) — hmmm am I going to be dinged…? And YUP. So we’ll stick to Canadian sites for now, shall we?

Was blinded by the excitement of buying a new pair of shoes on Friday from America, after purchase was immediately thinking of what fees I’m going to be dinged with at the boarder. (I’m in Saskatchewan)